mississippi income tax brackets

Mississippi Single Tax Brackets TY 2021 - 2022. Married Filing Joint or Combined.

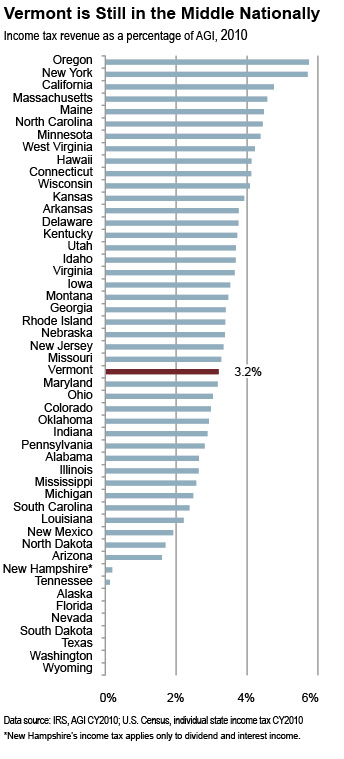

Vermont S Effective Income Tax Rate Dropped In 2010 Public Assets Institute

This means that these brackets applied to all income earned in.

. Mississippi does allow certain deduction amounts depending upon your filing status. What is the Single Income Tax Filing Type. Compare your take home after tax and estimate.

Mississippi Income Tax Brackets and Other Information. Mississippi has a graduated tax rate. This means that your income is split into multiple.

As you can see your income in Mississippi is taxed at different rates within the given tax brackets. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Mississippi Tax Brackets for Tax Year 2022.

Below is listed a chart of all the exemptions allowed for Mississippi Income Tax. 2022 Mississippi Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. This means that these brackets applied to.

Mississippi has an opportunity to become the 10th state without an individual income tax and to do so with sales tax rates which while certainly high are in line with regional. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. 2300 exactly 12 of the 4600 See more.

Tax Bracket Tax Rate. The state income tax system in Mississippi is a progressive tax system. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent.

Box 23050 Jackson MS 39225-3050. There is no tax schedule for Mississippi income taxes. All other income tax returns P.

Detailed Mississippi state income tax rates and brackets are available on. Mississippi state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with MS tax rates of 0 4. The plan would immediately eliminate the 4 tax bracket starting in 2023 at a cost of about 185.

Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. The taxable wage base in Mississippi is 14000. Mississippi also has a 400 to 500 percent corporate income tax rate.

These rates are the same for individuals and businesses. The graduated income tax rate is. Mississippi Income Tax Rate 2022 - 2023.

Mississippi Income Taxes. Because the income threshold for the top. Box 23058 Jackson MS 39225-3058.

Detailed Mississippi state income tax rates and brackets are available on. Any income over 10000 would be taxes at the. Still the state does impose Social Security and Unemployment Insurance SUI on employees.

Another day another tax cut proposal in Mississippi Legislature. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Mississippi Income Tax Brackets.

This means that these brackets applied to all income earned in 2014 and the. Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent. If you are receiving a refund PO.

SUI rates in Mississippi range from 0 to 54.

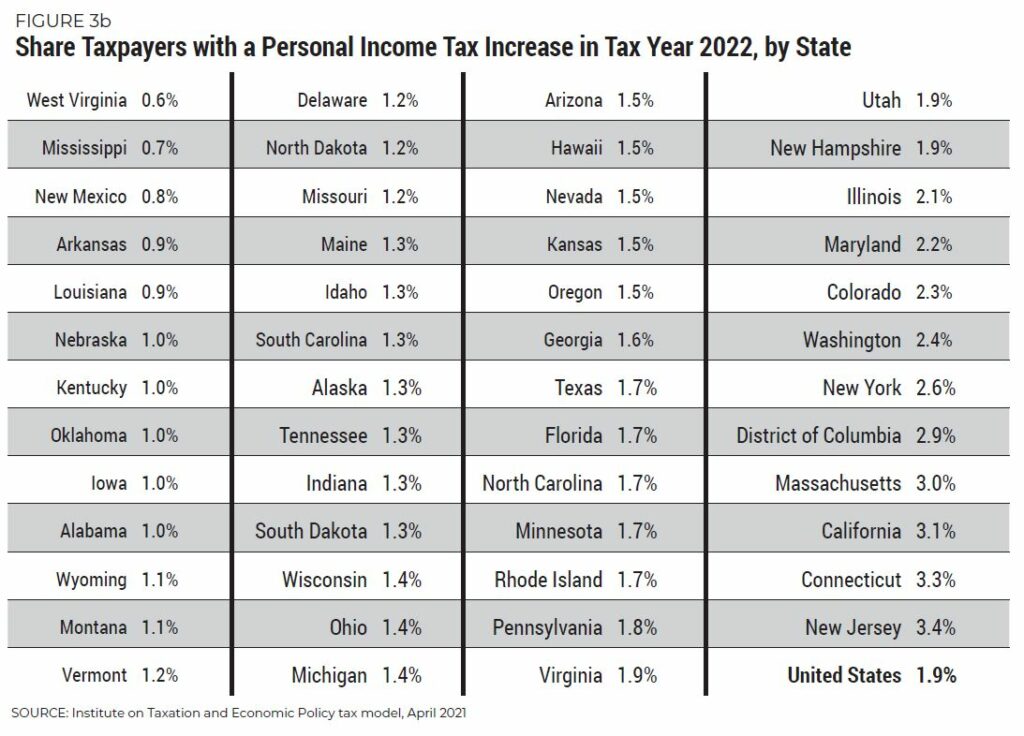

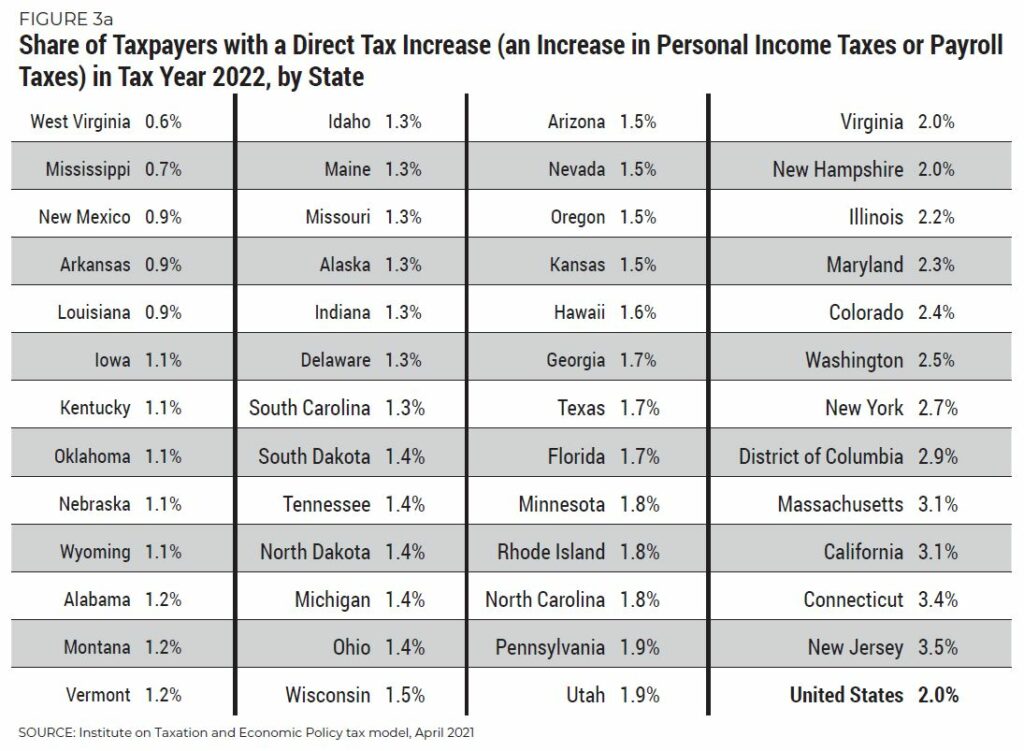

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Mississippi Tax Brackets And Rates 2022 Tax Rate Info

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

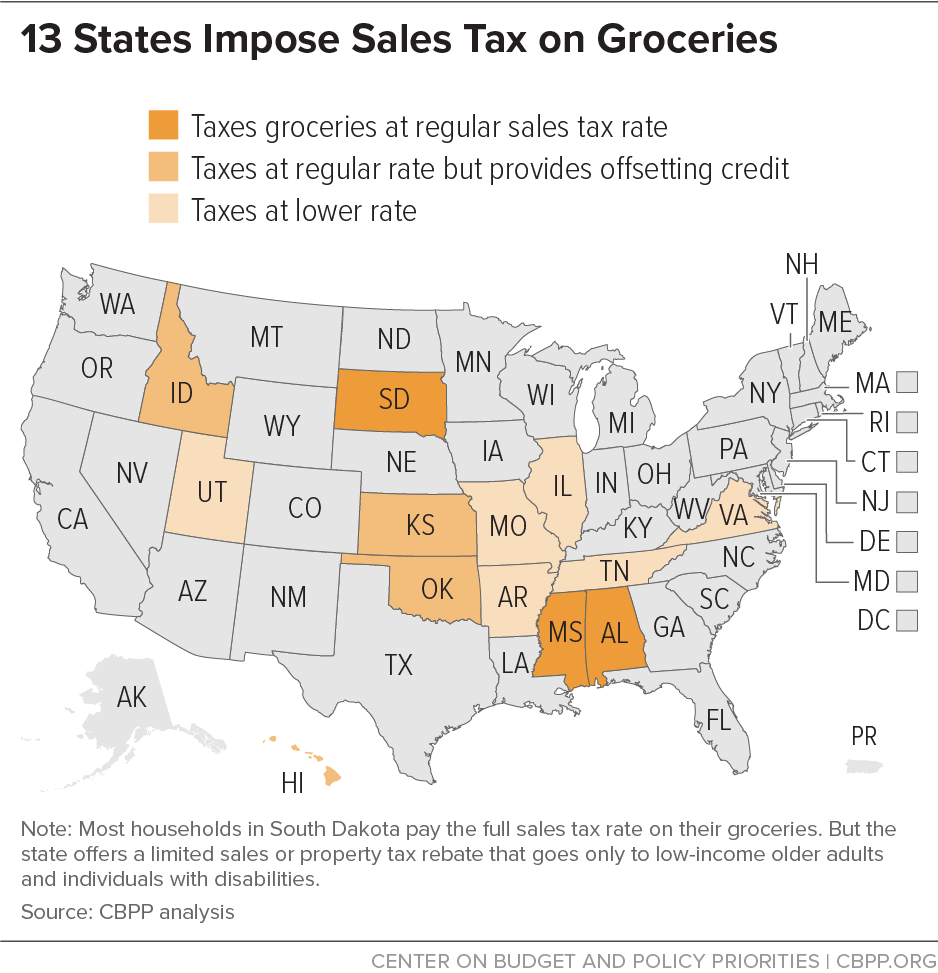

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi State Tax Tables 2022 Us Icalculator

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

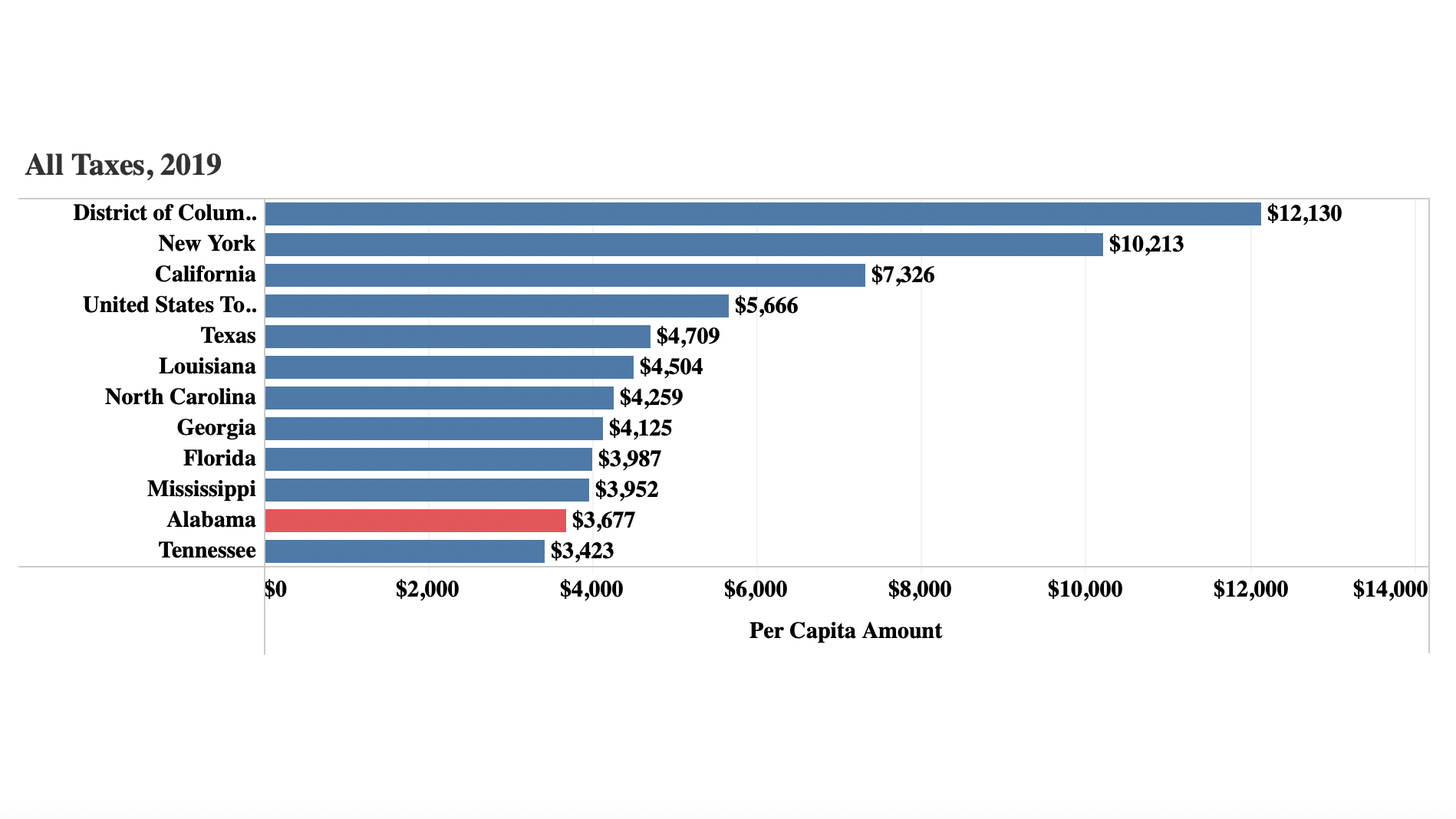

Parca Report Shows Alabama Has Nation S Second Lowest Tax Collection Per Capita

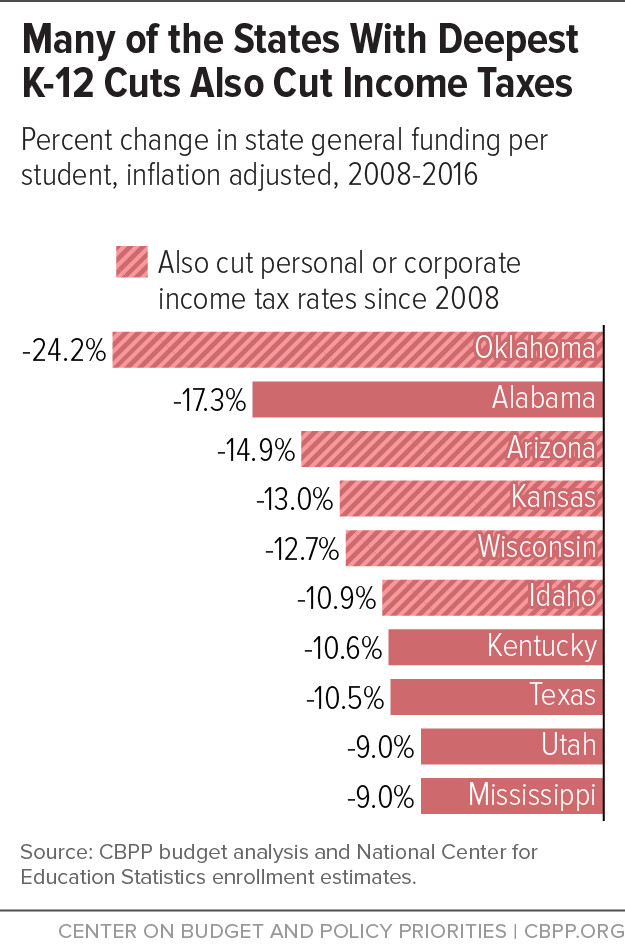

Mississippi Tax Cuts Would Worsen Education Squeeze Center On Budget And Policy Priorities

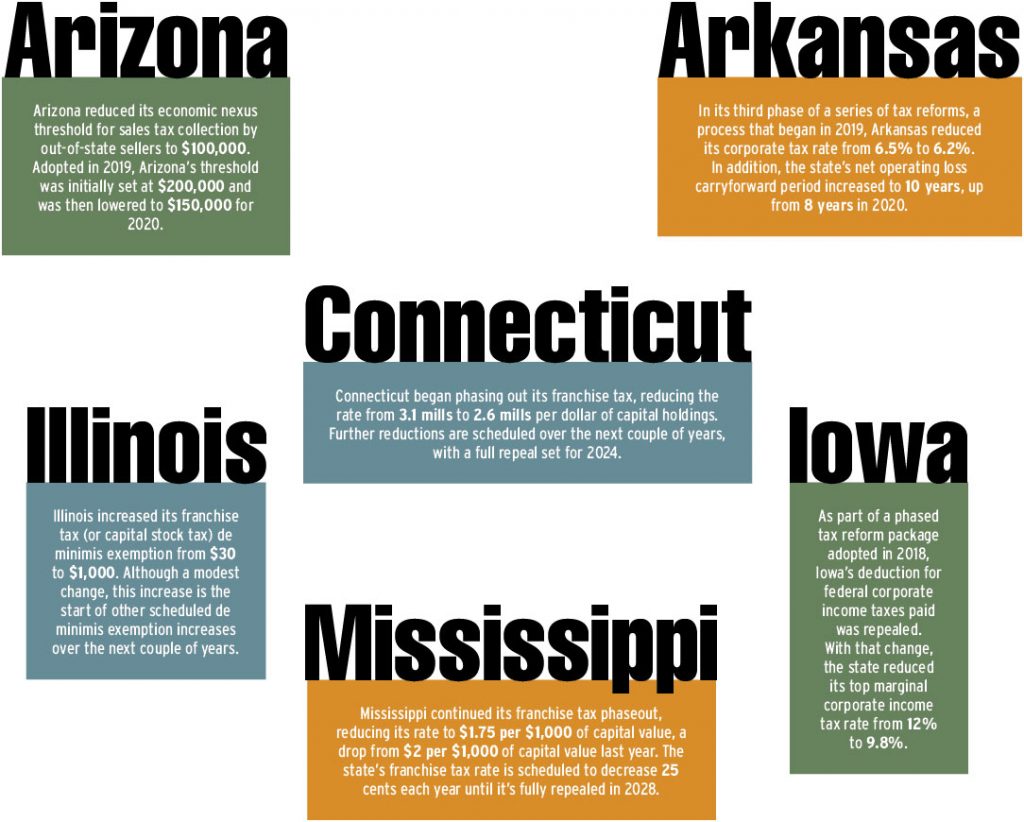

State Tax Updates In 2021 Tax Executive

State Tax Levels In The United States Wikiwand

Mississippi State Income Tax Ms Tax Calculator Community Tax

Speaker Gunn Rolls Out Graphic Comparison Of House Vs Senate Income Tax Cut Proposals Mississippi Politics And News Y All Politics

Prepare Your 2022 2023 Mississippi State Taxes Online Now

Mississippi Becomes Third State This Year To Move To Flat Tax The Sentinel

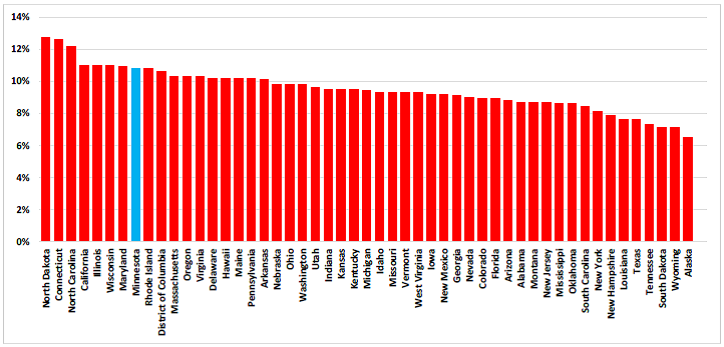

Minnesota Should Reduce Its Individual Income Tax Rates American Experiment

Historical Mississippi Tax Policy Information Ballotpedia

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation